Key to Success: Understanding the

Target Company

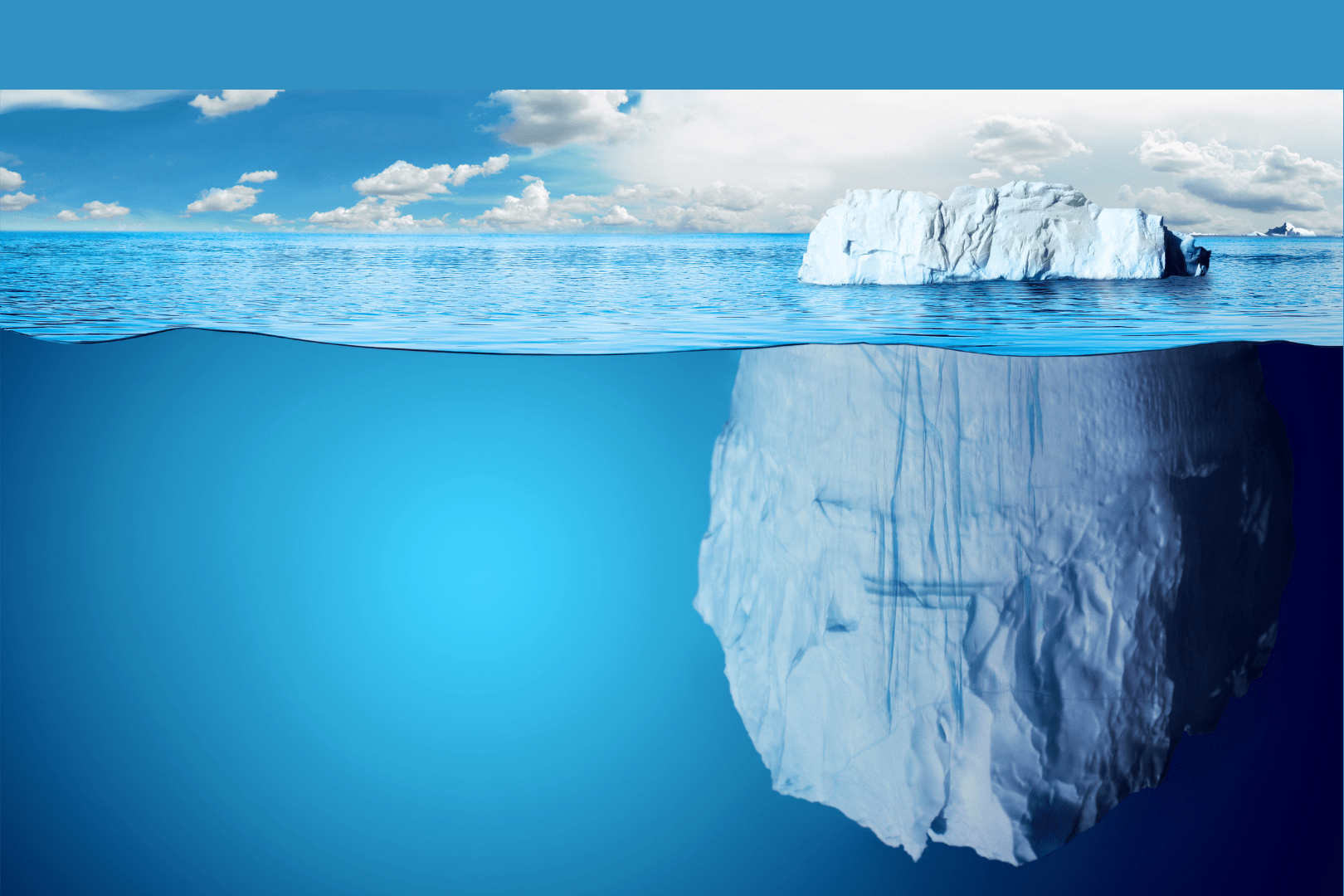

An acquisition means taking over not only the assets and operations of the target company, but also its reputation, legal risks, customer and supplier relationships, in other words, its overall ethical stance. Do you know the target company enough to take these risks?

Know your target company to seal the M&A deal right!

Mergers and acquisitions are intricate endeavors entailing substantial investments and pivotal decisions. Given the potential pitfalls like legal breaches, unethical conduct, or non-compliance that could lead to hefty costs and tarnished reputations post-merger or acquisition, delving into the ethical and compliance landscape of the target company and its partners is paramount.

The background of the target company often holds clues to potential future risks, especially concerning legal adherence and ethical benchmarks.

At Cerebra, we bolster your decision-making prowess prior to mergers and acquisitions by orchestrating meticulous due diligence investigations and intelligence gathering on both target companies and individuals.

Contact Us